Alaska fishermen and processing plants are in limbo as a state-backed seafood company teeters

“We are all sort of on pins and needles,” said a local official in King Cove, where fishermen and elected leaders are waiting to learn the fate of Peter Pan Seafoods' shuttered plant.

Northern Journal is a reader-supported publication. To receive new posts and support my work, consider becoming a free or paid subscriber.

The fishing fleet in the Southwest Alaska town of King Cove would have been harvesting Pacific cod this winter.

But they couldn’t: Skippers had nowhere to sell their catch. The enormous plant that usually buys and processes their fish never opened for the winter season.

The company that runs the plant, Peter Pan Seafoods, is facing six-figure legal claims from fishermen who say they haven’t been paid for catches they delivered months ago. King Cove’s city administrator says the company is behind on its utility payments. And now, residents fear the plant may stay closed through the summer salmon season, which would leave the village with just half of the revenue that normally funds its yearly budget.

“We should be fishing right now,” said Ken Mack, a longtime King Cove fisherman. “Ain't much to do besides trying to get money that they didn't pay last year.”

The plant closure in King Cove is just one impact of the ongoing turmoil at Peter Pan, a major Alaska seafood processor. The upheaval comes amid continuing low global fish prices that have stressed all levels of the industry.

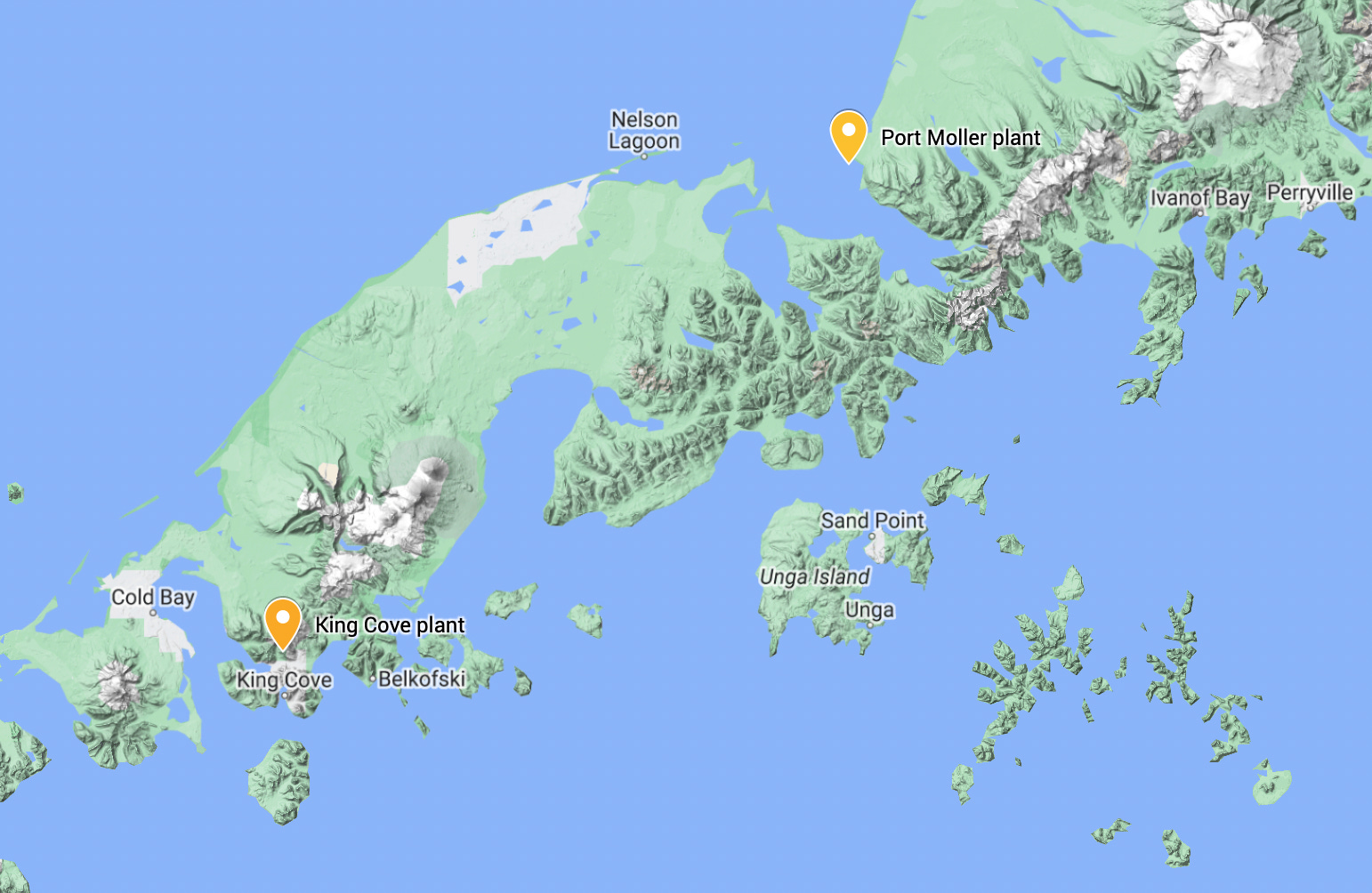

Peter Pan owns plants in King Cove; in the remote Alaska Peninsula outpost of Port Moller; in the Bristol Bay hub town of Dillingham and in the Prince William Sound city of Valdez. In interviews this week, community leaders, industry players and Peter Pan fishermen said they’re in limbo as they wait to find out if the company will survive, fold or somehow restructure its business.

“We are all sort of on pins and needles,” said Gary Hennigh, King Cove’s city administrator. “The greatest frustration is just: Tell us straight what's happening. Don't keep leading us on.”

Neither Peter Pan part-owner Rodger May nor officials from McKinley Alaska, an Anchorage-based finance firm that manages an investment in the company, have said much publicly about the fate of their business. That’s even as conflicting, anonymously-sourced stories about their plans have proliferated in seafood industry publications.

In response to emailed questions that included references to Peter Pan fishermen’s claims, Rob Gillam, McKinley Alaska’s president, did not respond directly to assertions about unpaid bills but said in a prepared statement that it’s a “very challenging time in the Alaska seafood industry and at Peter Pan Seafoods.”

An oversupply of fish, high interest rates and skepticism from lenders “have collided to seriously impact the industry and the communities and fisherman who rely on it,” Gillam said.

“We are actively working with Peter Pan's ownership and management teams to navigate the situation,” he added. “We remain hopeful a positive outcome can be found.”

May didn’t respond to a request for comment.

The stakes are substantial not just for fishermen and the communities that host Peter Pan’s plants. The state of Alaska also holds a significant financial interest in the company.

The money that McKinley invested in Peter Pan comes from the Na’-Nuk Investment Fund, which is managed by the finance firm.

Of the $117 million raised for Na’Nuk by mid-2022, $100 million was from the state-owned Alaska Permanent Fund Corp., according to a fact sheet published by McKinley.

The exact amount of Na’Nuk’s investment in Peter Pan was not disclosed.

Industry-wide stress

For four decades starting in the late 1970s, Peter Pan was under Japanese ownership.

Fishermen and local leaders complained that owner Maruha Nichiro, a global seafood firm, was underinvesting in Peter Pan during a period when there was competition from other fish buyers. But the company managed to keep its plants open.

After buying Peter Pan in 2020, its new owners — May, the Na’Nuk fund and a California investment firm called Renewable Resources Group — promised to revitalize and grow the business. After the acquisition, to recruit fishermen who were selling to other processors, they offered to pay high prices for salmon.

“You’ve got to put more pounds through the plants, put more fish through the plants. When you do, you get more efficient, the costs come down, that benefits everybody,” Gillam told KDLG, the Bristol Bay public radio station, in 2021. “It means you pay fishermen a little bit more. It means you can provide more benefits to the people who work there. It means you can lower the cost against which you can sell your product into the market.”

Initially, the new company, like the rest of Alaska’s seafood industry, benefited from huge salmon runs and strong prices in the global markets where much of the state’s catch is sold.

But after the 2022 season, demand started eroding and fish prices fell dramatically.

Spiking interest rates increased the cost of borrowing money — a crucial tool for seafood processors, who must spend huge sums flying workers to remote plants, buying canning and freezing supplies and subsidizing fishermen’s pre-season expenses, all before a single salmon is caught. And the high value of the U.S. dollar made the industry’s products more expensive for foreign buyers.

Those trends have destabilized Alaska’s fishing industry at all levels.

Salmon fishermen staged public demonstrations last summer to protest lower prices they were offered for their catch. Other processing companies have announced plant closures. And Trident Seafoods, one of the industry’s biggest players, is selling off four of its 11 Alaska plants as part of what it describes as a “strategic restructuring.”

Unpaid bills and a shuttered plant

Trouble at Peter Pan has been brewing since last year.

More than a dozen liens — legal claims of unpaid debts — have been filed against the company since mid-2023 by fishermen, a transportation business and other vendors.

Some have been lifted, but others remain. Those include a claim filed Tuesday by a King Cove fisherman who said he’s still waiting for $175,000 that Peter Pan owes him for 2 million pounds of salmon and 130,000 pounds of Dungeness crab delivered between June and October.

In January, the company said it wouldn’t open its King Cove plant to buy fish during the winter season — a last-minute announcement that shocked the village’s fleet and left many of them without a market for their catch. There are now 20 boats docked in the community that would otherwise have been fishing, Warren Wilson, King Cove’s mayor, said Friday.

“Everything was lined up to happen. The last day, they cut it off — it was the worst thing in the world,” Wilson said. “We lost a year because of this stuff. Our fleet is suffering.”

Fishermen and community leaders are now waiting to find out if Peter Pan will open the King Cove plant for the summer salmon season. Doubts have also spread among the few dozen fishermen that deliver salmon to Peter Pan’s remote plant in Port Moller, 100 miles northeast of King Cove on the Bering Sea side of the Alaska Peninsula.

Pat Collins, a longtime skipper who lives in Montana and fishes from Port Moller in the summer, said he’ll soon have to free his crew member to work on another boat this year — unless he gets more clarity about Peter Pan’s plans for the plant.

“In good conscience, it’s probably going to be this week or next that I just let him go. The guy has opportunities all over the place,” Collins said. He added: “I’m 68 years old. I’m quite financially comfortable — I made a lot of money in that area, and if I don’t go, it’s no big deal. But ask my wife: I’ve been up numerous nights, feeling sick for my industry and for King Cove. They have a special place in my heart.”

Fishermen, tenders could flee

Peter Pan has held meetings with its fishing fleet in recent weeks where executives said they still plan to open their plants this summer, according to fishermen.

But now, “rumors abound” about possible closures, said Hennigh, King Cove’s city administrator.

The seafood industry publication Intrafish has reported that Peter Pan brought in a financial firm “to explore refinancing or joint venture options.” Another publication, Undercurrent News, reported Friday that the company has approached other Alaska processors “about buying or even leasing its plants.”

Mack, the King Cove fisherman, said he spoke with May, one of the owners, this week, who told him the company is “still looking for a bank to get finances, so they could run the plant for a year.”

The company, in its current form, faces multiple obstacles to successfully operating its King Cove and Port Moller plants this summer, according to fishermen and community leaders.

One problem is a possible shortage of tenders — the transport boats that pick up salmon from fishermen at sea and deliver them to shore for processing.

“The tenders that were hanging around, thinking that they would be working for Peter Pan, I think have seen the handwriting on the wall that that's not going to happen,” said Hennigh, the King Cove administrator. “So, they're trying to get tendering jobs with other plants.”

Others say that few fishermen will take the risk of selling their catch to Peter Pan when it faces so many liens.

“Do you want to get paid? Nobody’s fishing for Peter Pan unless you’re crazy,” said Bo Oglesbee, who sold his salmon to the company’s Port Moller plant for years but this summer will deliver his fish to tenders working for another processor, Silver Bay Seafoods.

Mack said his family’s summer salmon harvest will likely be sold to Trident and Silver Bay plants in the communities of Sand Point and False Pass.

“We won't give Peter Pan no salmon because they ain't giving us no help, and we can't give them no help later,” Mack said.

Even if Peter Pan is restructured or sold, fears persist about what could happen to the company’s Southwest Alaska plants given what some experts describe as excess processing capacity in the region.

A continued closure of Peter Pan’s King Cove plant would have serious impacts in the community, said Hennigh.

The local government could see its yearly fish tax revenue drop by more than $1 million, with additional six-figure losses in sales tax receipts from fishing boats buying fuel in other places.

Another $200,000 deficit could come from reduced use of the municipal water system by Peter Pan’s plant, and a new solid waste incineration system may have to be redesigned for lower demand.

The community has between $5 million and $6 million in savings it can use to cover deficits temporarily. But cuts to services like police will be up for discussion soon, Hennigh said.

“We can't wait very long until we have to start putting some real plans in place,” he said.

King Cove’s residents, he added, aren’t “pessimistic people.”

“But the reality of our environment, our accessibility — if it ain't meant to be fishing, we just don't have any alternatives,” he said. “There’s no magic answer here.”

I make Northern Journal’s stories available, for free, to news outlets — and Alaskans — across the state. I only earn money when readers pay for a voluntary membership. If you find this information useful, please consider joining. If you’ve already signed up, thanks so much for your support.