As salmon season kicks off, some Alaska fishermen fear for their futures

A year into the the crisis in Alaska's $6 billion commercial fishing industry, there are some signs of recovery. But major threats persist, many of which fishermen feel powerless to affect.

Northern Journal depends on reader contributions to sustain reporting like this. If you've already become a member, thank you; if you haven't, please consider a voluntary membership.

HOMER — On a brilliant spring morning, Buck Laukitis, a longtime fisherman from this Kenai Peninsula town, stood at the city dock watching his catch come ashore.

Crew members aboard Laukitis' boat, the Oracle, filled bags with dozens of halibut — some of the fatter ones worth $200 or more — which a crane would lift up to the dock. There, processing workers on a small slime line weighed the fish, tossed crushed ice into the gills and slid them into boxes for shipment to Canada.

Harvest, unload, sell, repeat — exactly how the iconic Alaska commercial fishing industry is supposed to work. Until you ask Laukitis about the Oracle's sister vessel, the Halcyon.

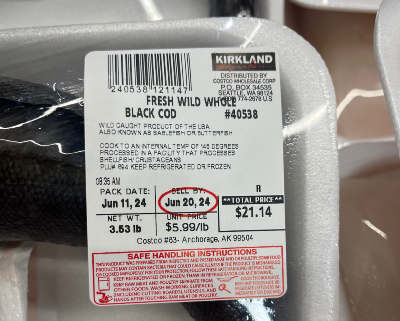

Instead of fishing for another species, black cod, like it’s built for, the Halcyon is tied up at the dock.

For Laukitis to make money, processing companies would need to pay $2.50 for each pound of black cod delivered to a plant. But right now, buyers aren’t paying much more than $1.50, he said.

With Laukitis on the dock last month were his young grandkids and adult daughters — fishermen who run a popular brand called the Salmon Sisters.

Those generations, he said, were on his mind as a sharp downturn in Alaska’s fishing industry continues looming over his livelihood. Some say that the crisis, driven by an array of market forces and economic factors outside fishermen’s control, is the biggest for the industry since statehood.

“We’re trying to do multi-generation fishing,” Laukitis said. “But believe me: It keeps me up at night, wondering about the future.”

Roughly a year into the downturn, with the major summer harvest of salmon just starting, there are some signs of recovery. Some fishermen say they managed to turn profits even after last year’s plunge in prices. And startup businesses are launching new models for processing that they say could help boost the quality and value of Alaska’s catch.

But major threats persist, many of which fishermen feel powerless to affect — posing existential risks to a $6 billion industry that employs more than 15,000 Alaskans.

Industry and state elected leaders say they expect Russia to continue selling huge quantities of fish into global markets, undercutting the prices of Alaska’s harvests — which also have to compete with farmed fish.

Inflation and high borrowing costs are hammering processing companies, which typically take out huge loans to buy supplies and stage workers and equipment at the start of each summer salmon season. Plants and whole processing businesses have shuttered around the state, while others are putting assets up for sale.

Then there’s the long-term uncertainty that comes with global warming, which appears to be boosting some fish populations but disrupting others.

Fishermen who have made big investments in recent years now own permits that could be worth a fraction of the purchase price.

Permits to participate in the typically lucrative Bristol Bay salmon fishery were going for $260,000 two years ago; now they’re selling for $140,000.

Many skippers face steep startup costs for the summer season without much confidence that their harvest will pay off. Some who are nearing retirement are having to postpone those plans until they can sell their boats and permits at higher prices.

“There are people who literally cannot afford to go fishing. They're going to be paying money out of their own pocket to deliver their fish pretty soon,” said Maddie Lightsey, who brokers sales of permits and boats at her family business in Homer. “But they also can't afford to sell, because the market has crashed and come down so far that they're dramatically upside down on their loans.”

Most Alaska fishermen are in the business for the long haul, not for short-term investment returns. But some, like 41-year-old Erik Velsko, are starting to hedge their bets.

Velsko, another longtime Homer fisherman, is training to be a ship’s pilot, in case his chosen career doesn’t work out. Others said they’re looking at jobs in health care and aboard state ferries.

“That’s how much faith I have in, at least, the fisheries we’re doing,” Velsko said. “It was pretty good, for quite a while.”

“Nothing to fall back on”

The industry turmoil first started generating big headlines after last summer’s Bristol Bay salmon harvest, when processing companies announced they would pay fishermen per-pound prices that were roughly half of the previous year’s.

The prices, which prompted vehement protests from fishermen, were the lowest in two decades, and they could end up being the lowest on record, according to a preliminary analysis by the Alaska Seafood Marketing Institute.

But the focus on salmon has, to a degree, overshadowed that the crisis is broader, covering an array of other species.

Among the biggest problems is pollock — a whitefish harvested in huge quantities in the Gulf of Alaska and Bering Sea. It’s sold into markets in Asia, Europe and the U.S. to make products like fish sticks, fried fish sandwiches and imitation crab.

Many of Alaska’s big processing companies depend on revenue from consistent, multi-season harvests of pollock to smooth out the short, frenetic summer salmon season.

But processors say that huge increases in aggressively low-priced sales of pollock products from Russia — particularly of surimi, the fish paste used to make fake crab — are crowding them out of the market, especially in Asia and Europe.

Processors say they’re also facing increased competition from Russia-caught salmon, and from farm-raised fish. Other species, like black cod, are also fetching rock bottom prices — meaning that even fishermen who have diversified into multiple species aren’t insulated from the chaos.

“There’s nothing to fall back on. Everything, across the board, is in trouble,” Lightsey said. “This is different from other downturns in that way.”

Other dynamics that processors say are limiting the prices they can pay for fish include a historically low value of the Japanese yen against the U.S. dollar. That’s limited the demand for Alaska products in a country that’s often been a huge market.

Inflation and sharply rising borrowing costs in the past two years are also big problems.

Processing companies often take out loans of tens of millions of dollars at the start of each salmon season — money for buying empty cans and plastic, flying workers to remote plants and funding pre-season boat upgrades, insurance policies and other necessities for the skippers who sell them fish.

“You had interest rates go up by three times,” said Rob Gillam, whose McKinley financial and research businesses have studied and invested in the Alaska seafood industry in recent years. “At the same time, what we can sell the fish for is going down, not up.”

Wages for processing workers, like for those in other industries, have also spiked. At a news conference last month, Joe Bundrant, the chief executive of the huge processing company Trident Seafoods, said labor costs have risen by 240% in the past five years, with diesel fuel prices also rising sharply in the same period.

“All the while that the Russians were weaponizing their seafood industry against us, we’ve seen unprecedented cost increases,” said Bundrant. His company is based in Seattle but has operated 11 plants in Alaska — four of which Trident put up for sale last year.

Deferred loans and deepening debts

Processing companies’ woes trickle down to skippers and crew, since fishermen depend on the prices those businesses can pay for their catch. Some of the same trends hitting the processing companies, like inflation, are also affecting fishermen directly.

In interviews, numerous Homer fishermen said they’re facing steep increases in the cost of insuring their boats for the summer salmon season. Jennifer Hakala, whose husband runs a boat in Bristol Bay, said the price of insurance for this year’s six-week fishery spiked to $8,000 from $5,000 in 2023.

To survive, some fishermen are deferring loan payments or taking on more debt. Others, like Hakala, are getting creative.

Typically, her husband hires two deckhands to help on the boat, but this year, they’re depending on their 16-year-old son, and Hakala, who manages a Homer marine supply store, will help out, too.

“I'm going to fly in on the peak and help them finish off the year — and hopefully we make our boat payment,” she said, referring to the yearly amount that’s due on the loan the family took out to buy their vessel.

Most fishermen in Kodiak have been able to get through the past year without contemplating difficult decisions like bankruptcy, according to Danielle Ringer, a fisherman and fisheries scholar from Homer who’s now based on Kodiak Island.

She’s heard of some skippers who have been working as crew members in fisheries they don’t normally participate in. Others are thinking about working construction instead of taking the risk of gearing up their boat for this coming summer.

“It could be okay,” Ringer said. “But not if it’s a couple more seasons like last year.”

Ringer said she’s seen support coming from the state and federal governments for large and small seafood processing companies.

Those programs are legitimate, Ringer said, but she’d also like to see more support for individual fishermen, too — ideas like direct aid, or loan forbearance. She endorsed concepts being discussed by policymakers to create new programs modeled on federal supports for agriculture.

“For healthy fisheries and healthy communities, you need all of these different aspects,” she said. “Even if government folks and others are interested in supporting fishermen, I think there are still questions about how to do that the right way.”

Not all bad news

While many Alaska fishermen are struggling, others say they have managed to stay profitable — and that they see bright spots ahead.

Last year, Homer resident Scotty Switzer and his three crew members all made money fishing off Kodiak Island, where big runs of salmon made up for the low price they were paid.

“I’m just grateful to have made something,” said Switzer, 36. “Getting into this industry, I knew there were going to be ups and downs.”

Switzer took on hundreds of thousands of dollars in loans to acquire his permit, boat and other assets, and he’s still deeply in debt. But, like other fishermen working on their boats in the Homer harbor, he said he’s not feeling too anxious about his future.

“Probably should, could,” he said. “But, I’m in it now.”

For the upcoming season, one processing company, seeking to reassure fishermen, has already announced its minimum price for Bristol Bay sockeye salmon. Silver Bay Seafoods, one of the biggest Alaska processing companies, says it will pay a minimum of 80 cents a pound, a significant bump from the 50-cent minimum it paid last year.

Meanwhile, two startup companies, Northline Seafoods and Circle Seafoods, are hoping to revolutionize the industry’s traditional freezing and salmon processing methods — thereby fetching higher prices from consumers.

Typically, processors send big boats known as tenders to collect salmon from fishermen, then motor the catch back to plants on shore, where workers are flown each summer to handle the fish and operate equipment. Delays in pickup and delivery — and sometimes less-than-meticulous handling and chilling by fishermen — can translate into lower quality filets.

The two companies will park new, floating factory barges directly on or near the fishing grounds, reducing the amount of transit time once salmon are caught.

Once full of whole, frozen fish, the barges will be taken back to Washington state, where the salmon will be processed throughout the off-season without requiring workers to take expensive flights to rural Alaska plants.

“We’re trying to turn it into a manufactured good, as opposed to this seasonal rush of production that’s cut by temporary seasonal workers who have never seen a fish before,” said Charlie Campbell, Circle Seafoods’ co-founder. His company has raised $36 million from investors, loans and federal tax credits, he said.

A “bigger, more systematic downturn”

Alaska’s congressional delegation, led by Republican U.S. Sen. Dan Sullivan, has also been chipping away at the problems of Russian pollock and salmon exports.

While the U.S. banned imports of Russian seafood in 2022, a loophole allowed those harvests to continue entering America if they’d been processed in China or other countries.

Sullivan and other Alaska elected officials successfully pressured the Biden administration to fix that problem in December; he’s also appealed directly to European Union and Asian allies to consider tighter Russian import restrictions of their own.

“When the U.S. government moves in a coordinated fashion, it can get things done,” Sullivan said. “If we got international cooperation from the EU and Japan, there’s no doubt it would stabilize prices.”

Beyond pollock and salmon, there are reasons to be hopeful about the medium- and long-term prospects for two other key Alaska species, halibut and black cod, said Norm Pillen, president of the fishermen-owned Seafood Producers Cooperative, a small processor based in Sitka.

But the near-term is less promising, with continuing low prices and high borrowing and shipping costs, he added. Sitka fishermen are also nervous about a conservation group’s request to have the federal government list Gulf of Alaska king salmon under the Endangered Species Act.

“We’re going to have another tough year to get through,” Pillen said.

Back on the Homer dock, Laukitis, the boat owner, said that last year, he thought the turmoil in the Alaska fishing industry would be short-lived, like other dips that participants have had to periodically endure over the years.

Now, he sees it differently — as a “bigger, more systematic downturn” that’s landing directly on fishermen. Processing companies may not be able to control the prices they pay for fuel or packaging, but they can reduce the price they pay for fish.

“There’s a disequilibrium,” Laukitis said. “And we’re the ones getting squeezed the hardest.”