Interesting stuff: Dunleavy attends Trump fundraiser, solar for Alaska airports, and a company wants $50 million in state loans for natural gas drilling

Also: A renewable energy advocacy group says a recent ruling by state regulators is an "abdication" of their responsibility, and a contested election for leadership of Alaska's largest statewide Native organization.

Welcome back to Interesting Stuff, an occasional news digest from Northern Journal.

A reminder: Northern Journal is an independent news site and newsletter funded primarily by voluntary memberships. If you find the information in this report useful, please consider joining; if you're already a member, thank you.

Dunleavy attends Trump fundraiser co-hosted by Hilcorp billionaire

Alaska Republican Gov. Mike Dunleavy attended an oil industry fundraiser for former President Donald Trump in Texas earlier this month.

Dunleavy visited the state for business meetings connected to a natural gas pipeline project his administration hopes to build from Alaska’s North Slope to the Kenai Peninsula, the governor said in an interview.

While in Texas, he attended a reception in Houston to benefit Trump, he added. The event was co-hosted by billionaire Jeff Hildebrand.

Hildebrand is the founder of Hilcorp, a privately owned oil company that’s become one of Alaska’s largest producers in recent years. Hilcorp’s structure makes it exempt from state corporate income taxes — drawing an unsuccessful attempt by state lawmakers to change the law earlier this year.

Hildebrand and his wife have donated more than $1 million this year to Trump’s political operation, according to reports by Bloomberg and Climate Power.

Dunleavy's connection to Trump, meanwhile, has fueled speculation in Alaska's political circles about whether he could get a job in a future Trump administration. Dunleavy also sat in the former president's seating area at the Republican convention in July.

“I haven’t had that conversation with the president, yet,” Dunleavy said, when asked if he'd take a job with Trump in Washington, D.C. “You have to have the conversation.”

He added: “I would not rule it out.”

Transportation department eyes solar projects at Anchorage, Fairbanks airports

Could solar farms help power the major state-run airports in Anchorage and Fairbanks?

The Alaska Department of Transportation wants to find out, according to newly released public documents.

The department this month issued a 14-page request for information from firms interested in installing solar arrays at the two airports, which collectively consumed more than $5 million in electricity in the state’s last fiscal year.

The request asks firms to assess the potential for a 10-megawatt system at each airport, focused on "reducing energy costs and enhancing sustainability." A key requirement is a “detailed glare analysis” to ensure that any project would not cause safety risks to aircraft and pilots.

AIDEA considers loans for Cook Inlet drilling—and new oil leases and litigation in the Arctic Refuge

The board of Alaska’s embattled economic development agency, the Alaska Industrial Development and Export Authority, is set to consider some $70 million in spending and loans for oil and gas development near Anchorage and in the Arctic National Wildlife Refuge.

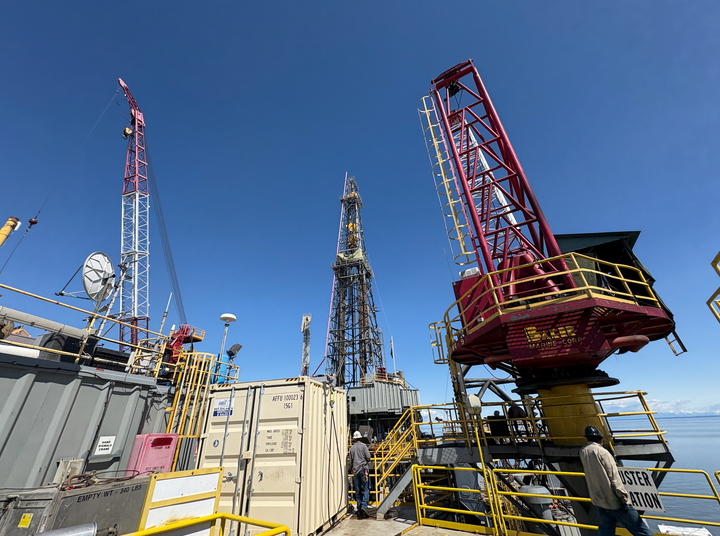

HEX, a privately owned Anchorage-based company, has asked AIDEA for a $50 million line of credit to finance five years of drilling — both in Cook Inlet, offshore of Anchorage, and onshore, on the Kenai Peninsula.

HEX's drilling effort, AIDEA’s staff wrote in a recent memorandum to board members, is “essential” to alleviate a forecasted shortage of locally produced natural gas. The fuel powers urban Alaska’s power plants and a Kenai Peninsula oil refinery, and utilities have been developing plans to fill gaps with imported liquefied natural gas.

HEX’s chief executive, John Hendrix, has repeatedly argued that drilling for gas on his company’s state leases is too risky unless the state grants concessions that improve his potential for profits.

AIDEA’s board is set to consider HEX’s request at a Wednesday meeting.

The financial terms of the company's line of credit as proposed by AIDEA staff, including the interest rate, have not been made public. AIDEA meeting documents said those terms are being provided separately to board members under a state law that allows for confidentiality of business information like income tax returns, business plans and trade secrets.

Also on Wednesday’s agenda is a proposal regarding oil leases in the Arctic National Wildlife Refuge. AIDEA's staff, led by Executive Director Randy Ruaro, is asking board members to allow him to bid on those leases in a sale that the Biden administration is required to hold before the end of the year.

AIDEA won leases at a previous sale held by former President Donald Trump’s administration. But those leases were later suspended and canceled by the administration of Trump’s successor, Joe Biden.

If board members approve the proposal, AIDEA would be authorized to spend up to $20 million on bids, consultants, experts and other associated costs.

A third proposal, if approved, would allow AIDEA to hire attorneys to prepare and initiate litigation against the federal government over issues including the upcoming lease sale. The proposal says the Biden administration may use flawed environmental reviews as a basis for making the "most productive portions" of the Arctic Refuge's coastal plain unavailable for oil development.

Green power advocates ask regulators to reconsider ruling that ignored gas conservation proposal

Late last month, a state commission released a major decision allowing Anchorage’s electric utility to raise its rates.

Now, a renewable energy advocacy group is calling on the Regulatory Commission of Alaska to reconsider numerous aspects of the ruling.

Among the reasons the decision should be reconsidered is because it failed to reckon with a proposed natural gas conservation scheme and amounts to an “abdication” of the commission’s legal responsibilities, according to Renewable Energy Alaska Project.

REAP was an intervenor in the commission proceedings reviewing the rate increase requested by Chugach Electric Association. REAP proposed a new pricing scheme for electricity that it said would give residential consumers an incentive to reduce their consumption — thereby preserving natural gas.

After the Regulatory Commission of Alaska filed an 89-page order last month that partially granted Chugach’s request for a rate increase and effectively ignored REAP’s conservation proposal, REAP last week filed a petition that asked the commissioners to reconsider.

The 19-page petition, sprinkled with italics and boldfaced type, is scalding. It asks the commission for nine different actions to correct a decision that REAP calls "unreasonable, erroneous, unlawful and otherwise defective.”

The petition specifically asks the commission to heed a state law that calls for the "conservation” of energy resources used to produce power — in this case, a reference to the diminishing supply of natural gas from Cook Inlet, near Anchorage, that Chugach has long depended on to run its generators.

Chugach filed a separate petition asking the commission to reconsider its rejection of part of the utility’s rate increase request. Chugach had asked permission to charge other utilities more to ship power across some of its transmission lines — specifically those that Chugach acquired when it bought Anchorage’s city-owned utility in 2020.

Village corporation leader, Sealaska executive vie for AFN co-chair

A Harvard University-educated village corporation leader is challenging the incumbent co-chair of Alaska’s largest statewide Native organization, the Alaska Federation of Natives. The election is set for Saturday during the group’s yearly convention.

The incumbent is Joe Nelson, who also serves as interim president of Sealaska, the Native-owned for-profit regional corporation for Southeast Alaska.

Nelson has been co-chair of AFN since 2020, while Ana Hoffman, a Native leader from the Southwest Alaska hub town of Bethel, is the other, though she is not up for re-election this year.

Nelson's opponent is Nathan McCowan, chief executive of the for-profit Native village corporation for the Bering Sea island community of St. George. McCowan also serves as board chair of the Alaska Native Village Corporation Association, an advocacy group representing the interests of the state’s Native-owned village corporations, of which there are some 150.

Looming over the campaign are the high-profile decisions by several Native organizations to withdraw from AFN over the past few years.

Three for-profit regional corporations, including Arctic Slope Regional Corp., Doyon Ltd. and Aleut Corp., have withdrawn.

Two regional tribal governments, Tanana Chiefs Conference and the Central Council of the Tlingit and Haida Indian Tribes of Alaska, have also pulled out of the federation.

McCowan, in a campaign video, pitched his ability to help unify the diverse organizations making up AFN — which include for-profit village corporations, regional corporations, tribal governments and nonprofits.

“Our greatest moments of triumph have come when we stand together, when we make ways for others away from the table to come back to it,” he said. “Our next great wave of progress will be because we compromise and stand together again.”

Nelson’s video, filmed during a walk in a forest with honking geese overhead, touted some of the Alaska Native community’s accomplishments over his four years as co-chair.

“We weathered a global pandemic. We sent our first Alaska Native to Congress,” he said, adding that there's one key piece of “unfinished business” for Indigenous people in the state.

“None of us can rest until we firm up our hunting and fishing rights for our grandkids,” he said.

A major North Slope oil project is ahead of schedule but way over budget

A major oil development currently under construction on Alaska’s North Slope is running about 20% over its budget, according to media reports from Australia, where the project’s owner is based.

Santos’ Pikka project is now expected to cost $520 million more than the $2.6 billion budget announced when the project was approved two years ago, according to a report on the “cost blowout” in the Australian Financial Review.

The project is still expected to generate financial returns of 20% at current oil price forecasts, the Review quoted Santos’ chief executive as saying. Pikka could also start up six months earlier than originally scheduled, he said.