LNG imports are likely coming to Anchorage. But advocates say policy changes can forestall them.

A new report says Anchorage's electric utility can put off the need for LNG imports by five years through renewable power projects and energy conservation.

This edition of Northern Journal is sponsored by The Boardroom, a shared workspace in Anchorage. I use their array of comfy and light-filled spaces as an alternative to my home office, and I also enjoy the free kombucha and convenient access to downtown. Check out membership options here.

If you pay for electricity or heat your home with natural gas in Southcentral Alaska, it’s going to get more expensive.

That’s one of the big takeaways from a pair of reports released this summer by two of the region’s utilities: natural gas company Enstar and Chugach Electric Association, the member-owned cooperative that provides power to the Anchorage area.

Read the Chugach and Enstar reports

The reports both suggest that importing liquefied natural gas is likely the best option to replace dwindling supplies of the fuel in Cook Inlet, Alaska’s oldest oil and gas basin.

When imports arrive at some point in the next several years, they will come at a heavy cost: an estimated $12 per thousand cubic feet of gas, which is some 50% more than Southcentral utilities pay now for Cook Inlet gas. Since fuel only makes up part of consumers’ utility bills, imports would translate into overall price hikes of 10% to 15% for power and even more than that for heating bills, though the numbers could rise or fall if preliminary cost estimates change.

The idea of paying those steep prices to fill supply gaps with imported fossil fuels is offensive to residents and elected officials across the political spectrum. Some say Alaska, as a leading oil and gas producing state, should continue serving its own needs, and others argue that utilities should be more quickly ditching gas for wind, solar and other new technologies.

But the most recent report, released recently by Chugach, also contains a silver lining that doubles as urgent policy advice: It says the utility can forestall the need for imports by as much as five or six years, through a combination of electricity conservation and swift construction of renewable power projects.

The question now is whether Chugach’s members and leaders will take action quickly enough to make that happen. And right now, consumer advocates argue that needed steps aren’t being undertaken, due to what they describe as a business-as-usual approach by Chugach’s leadership.

They cite Chugach’s recent proposal to revise its electricity prices, known as a rate case, as a major missed opportunity.

That plan, submitted to regulators earlier this summer, omitted any significant measures to incentivize reduced energy use by members. And some suggest that it could actually boost gas consumption through a proposed pilot program to lower rates for overnight electric vehicle charging, while raising them during the day.

Advocates had asked Chugach’s board to delay filing the rate case to allow the incorporation of electricity conservation measures, with the goal of preserving local gas supplies.

But board members voted to move ahead anyway, saying they needed to make sure the utility could raise its prices in time to solidify Chugach’s finances before a downgrade of its bond rating. Instead, the board asked Chugach’s employees to deliver a report and recommendations on new price structures by July 1, 2025.

“There wasn’t anything in the rate case to take into account the bigger picture that we need to be conserving natural gas,” said Gabby Markel, who helps lead a consumer advocacy group called Chugach Ratepayers Alliance.

Executives from Chugach, which currently uses one-fourth of the gas produced from Cook Inlet, say they see imported natural gas as a “transition fuel” that can be phased out as they bring on more clean energy projects. They’re focused on ensuring a reliable source of LNG imports by the time a gap in supply could develop within a few years, rather than on conservation incentives that, they argue, will not meaningfully reduce demand.

And the utility’s leaders say they have to make decisions about LNG imports soon because the infrastructure and permitting needed to bring in the fuel — likely to either a floating storage unit, or a repurposed export facility on the Kenai Peninsula — will take several years to prepare.

“We don’t see any degradation of demand, in a material way, over this time period,” Arthur Miller, Chugach’s chief executive, said in an interview. “Nor do we see advances in renewable generation that would materially impact the need to secure additional gas supply in 2027 and 2028.”

But others argue that Miller’s position flouts the findings of his utility’s own report, and say that Chugach can and should be putting more effort into conserving natural gas even as it takes necessary steps to prepare for imports.

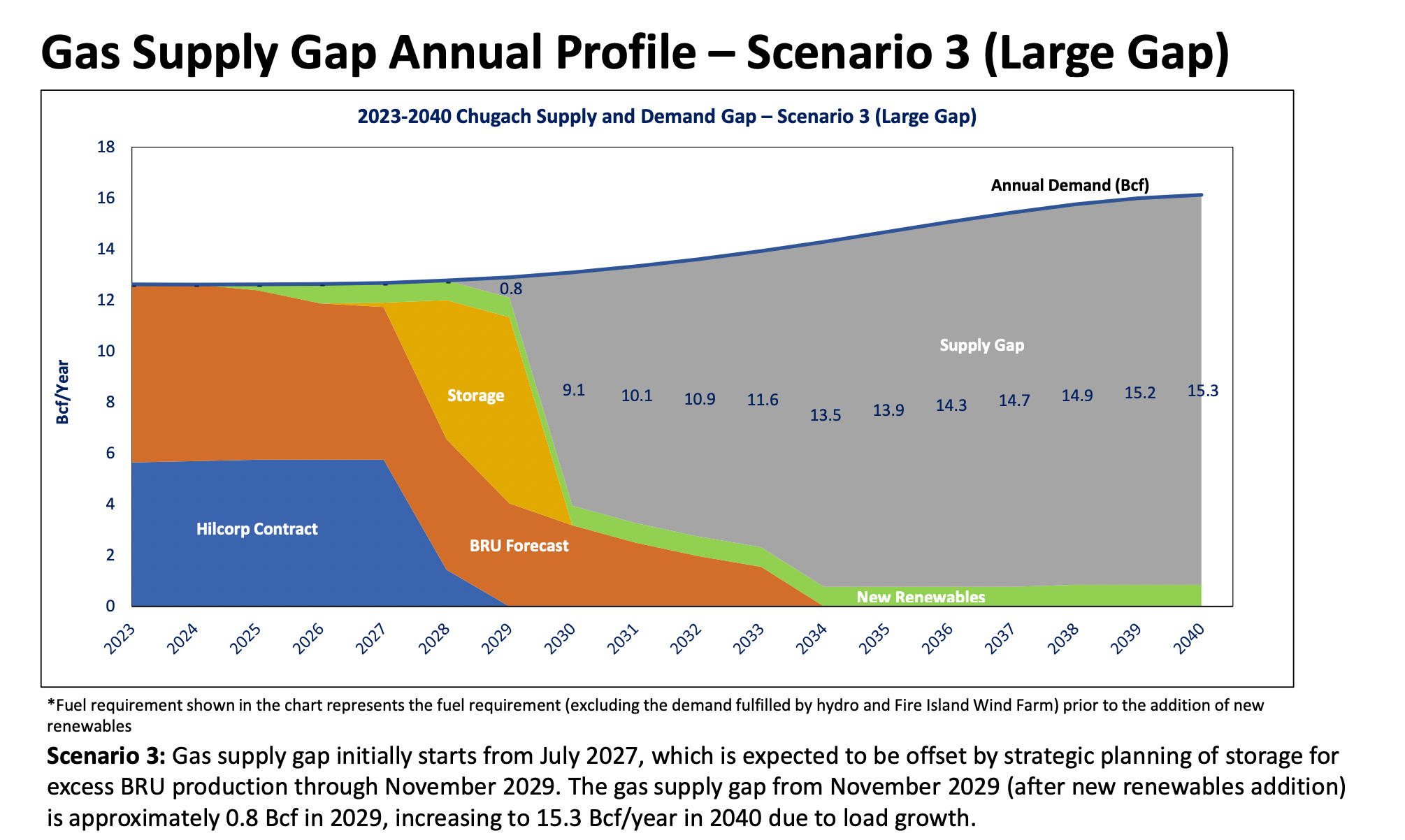

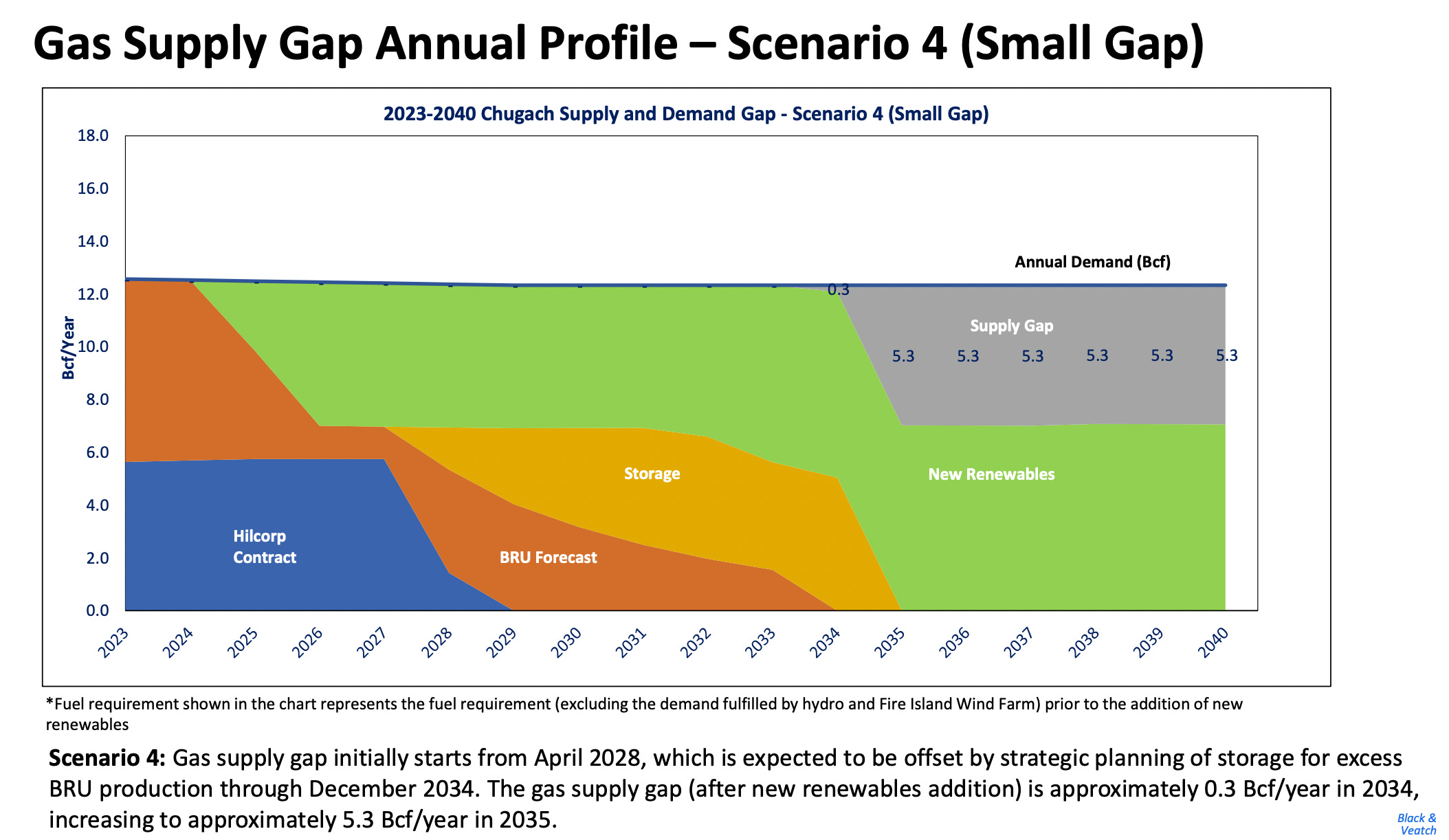

The 75-page report, drafted by global engineering and infrastructure firm Black & Veatch, outlines four different scenarios for Chugach’s gas supply gap, each with different assumptions about supply and demand.

In the worst-case, “large gap” scenario, Chugach members buy more electric cars and heat pumps, driving “aggressive” increases in demand for power. There’s also limited adoption of renewable power projects, and the resulting first gaps in gas supply would likely arrive in 2029, the report says.

Under the best-case, “small gap” scenario, Chugach brings on two major renewables projects — one wind, one solar — in 2025, and sees no growth in demand from heat pumps or electric cars. In that future, Chugach can likely stave off the first gas gap until 2034, the report says — five years later than the large gap scenario.

Such a delay would be valuable for Anchorage-area businesses, which already face utility rates 17% above the national average, said Bill Popp, head of the nonprofit Anchorage Economic Development Corp.

“It's a headwind for us if we see rates go up substantially,” Popp said in an interview. “It will, in many cases, give businesses pause about deploying new investments in Anchorage. And it can have an effect on whether workforce is willing to move here or stay here.”

When it comes to the kinds of renewable projects required by the “small gap” scenario, Chugach executives say they’re already working as fast as they can to bring them online — though consumer and renewable power advocates still argue that the utility could be moving even more quickly.

As for the second element of maintaining the “small gap” — efforts to limit or reduce electricity demand — the executives say that pricing strategies they could take through the ongoing rate case would have insignificant effects.

“You could increase the price, and people are still going to wash their clothes. They’re still going to run their dryer,” said Miller. “Our consumers are very inelastic, so it’s essential that we structure our approach to ensure not only reliability, but cost as a consideration.”

The primary goal of the rate case, Chugach officials say, is compliance with a regulatory requirement to align electricity prices that currently vary between the utility’s historic service area and a new area it added through the purchase of Anchorage’s municipally-owned power company in 2020.

Chugach officials say they will continue evaluating new rate designs to achieve the utility’s strategic goals. But they add that they’d have to do rigorous study of such measures to avoid unintended consequences, and also give members plenty of notice about changes.

Consumer advocates, meanwhile, say Chugach doesn’t have much time to wait, given the impending gaps in natural gas supplies. And, they add, there are incentives Chugach could adopt through its ongoing rate case that would, in fact, spur members to use significantly less power.

One concept, suggested by the Renewable Energy Alaska Project, or REAP, would ratchet up charges for each unit of power as members’ use exceeds certain amounts. This is known as an “inclining block rate,” and it has been used in other places, like Seattle, to encourage conservation.

But instead of including measures like those in its rate case, Chugach is proposing its pilot program to charge a few hundred members higher prices during the day and lower prices at night — with the idea that electric car owners could pay less to charge at off-peak hours.

The utility says that the concept, which may ultimately be expanded, is likely to reduce the amount of energy it must generate at times of peak demand, which could result in more efficient electricity generation.

But critics say that unless it’s paired with offsetting measures like incentives for installing rooftop solar panels, the proposal could encourage more members to buy and charge electric cars with the effect of actually increasing natural gas consumption.

“While I’m a big fan of electrifying transportation as a general matter, right now, I just do not see those as policies that Chugach should be particularly promoting,” said Antony Scott, a REAP policy analyst and former utility regulator. “And, you know, as a greenie, and someone who’s interested in EVs, it gives me heartburn to say that.”

Scott, an economist, cited a peer-reviewed 2018 study that found electricity consumers respond little to price changes in the first year, but that in the long run such increases can reduce consumption by nearly 1% for every 1% in increased rates.

Advocates like Scott argue that Chugach needs to embrace the parallel strategies that its own report shows could delay, by years, the arrival of the first tanker carrying expensive LNG.

Taking multiple simultaneous steps to stretch out remaining local gas supplies — actions like drilling more gas wells and incentivizing energy conservation — allows Chugach to keep its options open in case some of those measures don’t work, Scott said.

“We have to be able to do more than one thing at a time, right?” he said.

Northern Journal is a newsletter written by me, Anchorage journalist Nat Herz. It’s free to subscribe, and stories are also free to Alaska news outlets to republish through a partnership with the Alaska Beacon.

My goal is reaching the broadest possible audience of Alaskans. But if you can afford it, please consider supporting my work with a $100 annual or $10 monthly voluntary paid membership — these are currently my only sources of revenue for this project. Your support allows me to stay independent and untethered to the demands of the day-to-day news cycle. If you’ve already subscribed, thank you.